Comarch’s trade finance modulesupporting trade finance products at Raiffeisen Bank Polska S.A.

Comarch’s trade finance modulesupporting trade finance products at Raiffeisen Bank Polska S.A.

Back in 2009 Raiffeisen Bank Polska required a modern solution to manage a growing number of Trade finance products as well as an overwhelming amount of related paperwork.

At that time the bank had been issuing around 300 guarantees a month, delivered to destinations across the country and abroad. As the process was highly formalized, requiring a series of official approvals before the submission of each issuance order to the bank, it consumed a great deal of time and effort.

While waiting for green lights to move forward with not only guarantees but letters of credit as well, both the bank and the corporates it catered to kept being flooded with a torrent of paper documents, which gradually took its toll on everyone.

A troublesome path of applying for guarantees was the reason why we wanted the documents to take an electronic form and be available in real time both for our employees and customers. This meant reinventing our internal Trade finance processes, so that they’re smoother and safer at the same time.

Agnieszka Ziętek

Head of Guarantees, Raiffeisen Polbank

First: many corporates were used to processing Trade finance products in the previous way of exchanging e-mails or sending faxes, delivering documents in hard copies and signing issuance orders in pen. It did work, but there was a lot of room for improvement.

That’s just why the bank has come forward with a concept of digitizing the process, which was subsequently fine-tuned in the course of numerous brainstorming sessions involving both Comarch and Raiffeisen employees.

Second: the bank’s key customers included well-known European retailers who would use the Trade finance module on a daily basis, so providing them with a second-best solution was not an option. To up the ante, Raiffeisen decided to not only merge the module with their corporate banking system working 24/7, but also to notify corporates by email on a progress of any given operation – just to ensure that all parties are kept thoroughly informed.

We had to make the new solution as convenient as it gets from day one, especially considering it was a novelty on the Polish market. We did that, for example, by providing bank employees with numerous workshops and thorough product documentation, so they could test-drive the new ‘vehicle’ before actually telling corporates to hop in.

Agnieszka Piróg

Product Manager for Comarch Corporate Banking

The second feature was mostly unheard of at that time. On average, one had to make a phone call or send an email in order to be filled in on the status of a particular operation.

Zyta Juńczyk

Head of LCs, Raiffeisen Polbank

Just two years after the introduction of Comarch’s Trade finance module, we increased the volume of issued guarantees by 24% while the profits made off of them rose by 23%.

Agnieszka Ziętek

Head of Guarantees, Raiffeisen Polbank

Thanks to the new tool, Raiffeisen’s customers can order bank guarantees, open letters of credit and manage these products in one system, without visiting the branch office. These improvements translated into better performance of the bank.

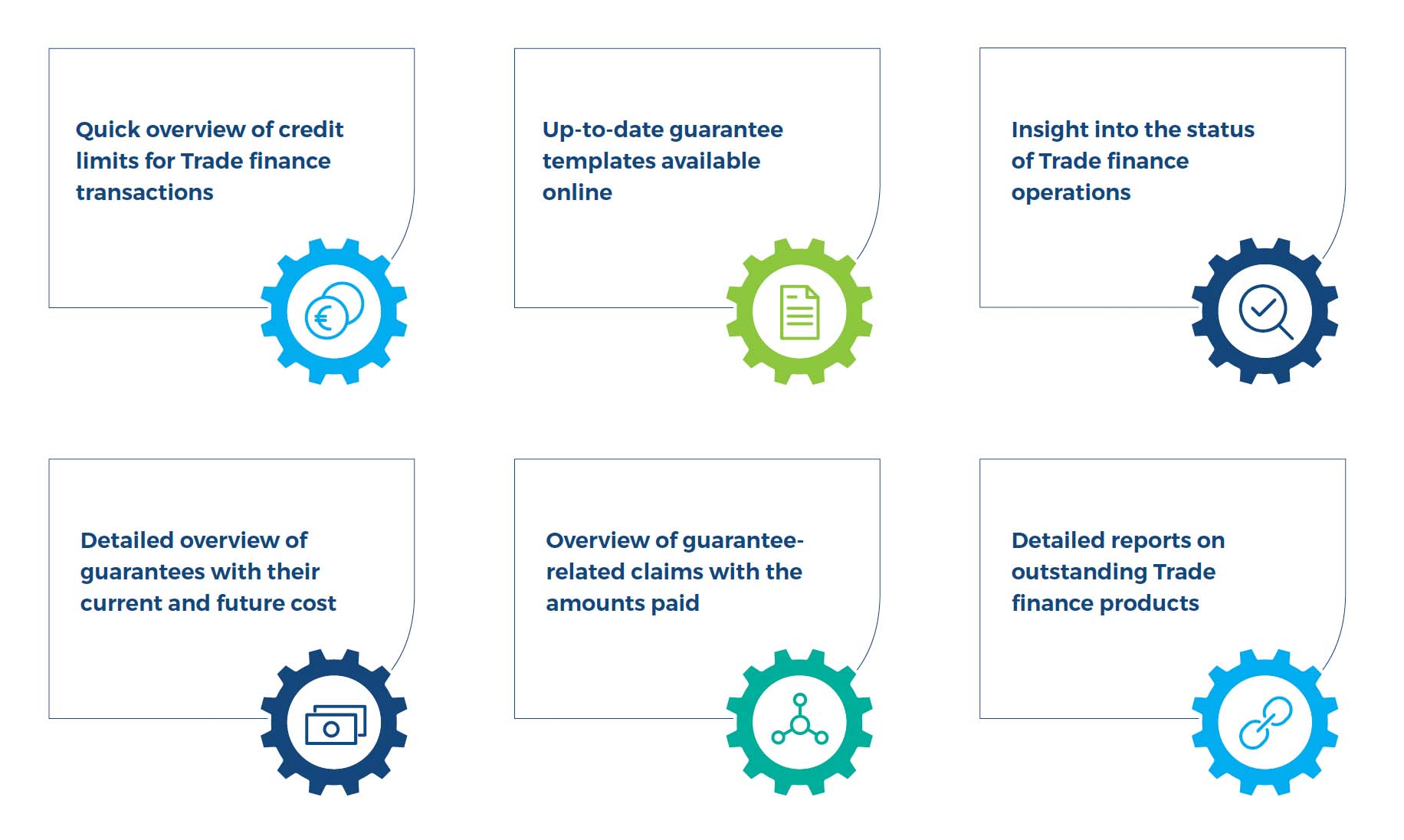

Raiffeisen was provided with Guarantees Online, a tool within the Trade finance module, enabling corporates to apply for guarantees easily and keep a detailed track record of the process. All of this is available around the clock with minimum paperwork involved.

Corporates can now also request issuance of a guarantee or open a letter of credit in the online banking system, which saves time and money, the more so as the request instantly reaches the relevant bank employee who is able to make tailored suggestions as to the guarantee model and confirm LC documents online.

Raiffeisen Bank Polska S.A. (currently operating under the Raiffeisen Polbank brand), the first bank with foreign capital on the Polish market (since 1991)

Banking

Enhacement of Trade finance processes

The Trade finance module of Comarch Corporate Banking

Comarch

A number of enhancements to our Trade finance platform have made our online banking friendly to any entrepreneur.

Zyta Juńczyk

Head of LCs, Raiffeisen Polbank

Thanks to this feature we decreased the time of issuing an average banking guarantee from two working days to several hours.

Agnieszka Ziętek

Head of Guarantees, Raiffeisen Polbank

Comarch Corporate Banking is a multi-channel and multi-product platform used to support corporate clients and medium-sized enterprises.

Thanks to applied solutions, modularity and wide customization options, the platform meets the expectations of even the most demanding banks. Owing to its integration capability with the existing bank systems, the solution is a universal, comprehensive, efficient and safe tool which streamlines the management of transactions, automates business processes and reduces business costs.

The system easily integrates with clients’ ERP systems; as a result, companies performing tens of thousands of daily transactions gain an effective tool to automate processes and streamline operations.

Raiffeisen Bank Polska S.A. began its operations in 1991. It offers a full range of financial services to individual customers including wealthy clients under the brand of Friedrich Wilhelm Raiffeisen private banking, and in corporate banking it focuses on the segment of small and medium-sized enterprises.

The members of the capital group of Raiffeisen Bank Polska S.A. include: Raiffeisen Investment Polska Sp. z o.o., Raiffeisen Solutions Sp. z o.o., operating an online currency exchange office RKantor.com, and Raiffeisen TFI S.A. In 2012, Raiffeisen Bank Polska S.A. was promoted to the group of top banks in Poland due to the integration with Polbank EFG S.A. The services of the Bank are used by 800 thousand customers through a network of 300 branches all over Poland and electronic banking systems, and through a modern call centre.

Tell us about your business needs. We will find the perfect solution.